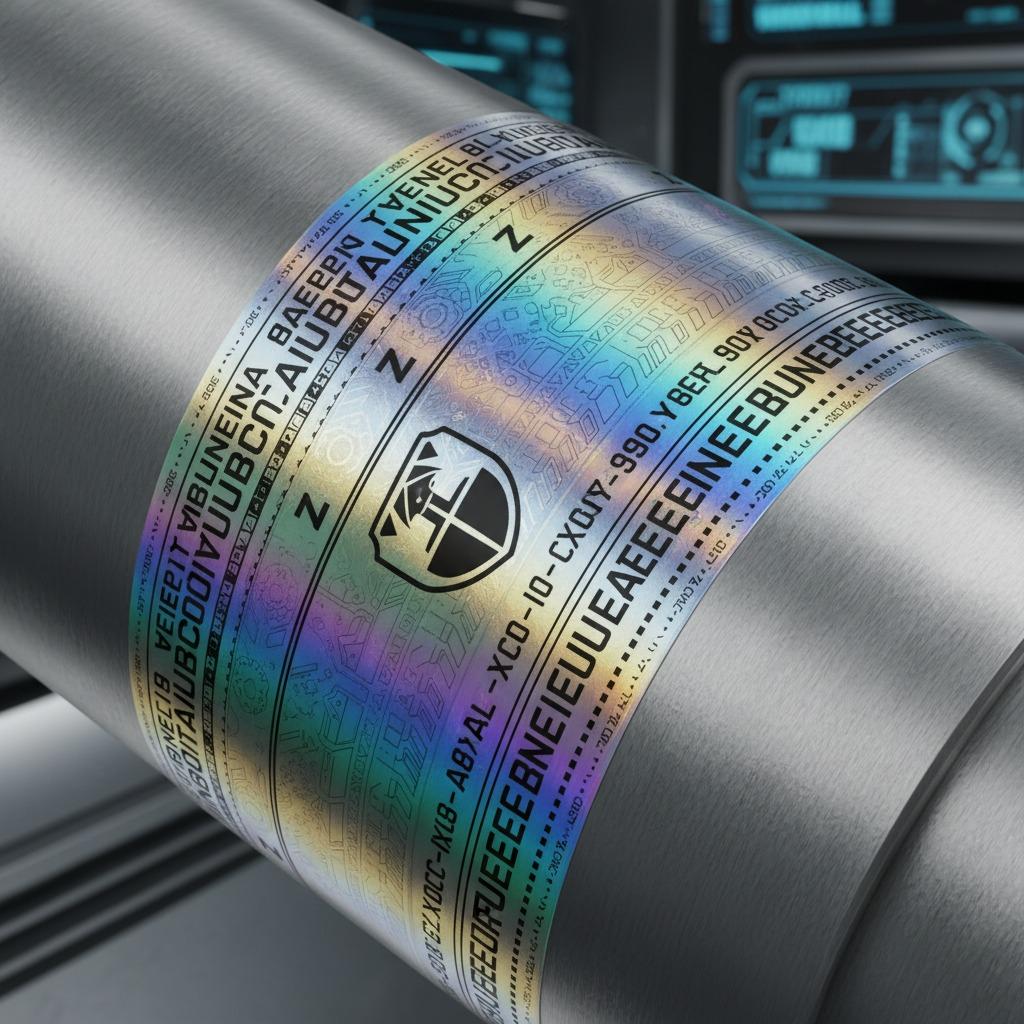

Tamper Evident Liquor Tax Stamp Printing: Built to Reveal Reuse, Refill, and Excise Fraud

A Liquor Tax Stamp Is Tested at the Moment of Tampering

Liquor tax stamps are not evaluated when bottles sit on shelves.

They are tested when someone tries to remove them.

If a stamp lifts cleanly, stretches back into place, or can be transferred to another bottle, the system has failed.

For excise authorities, that failure signals unpaid tax, unauthorized circulation, or counterfeit substitution.

This is why tamper evident liquor tax stamp printing is treated as a security process—not a graphic one.

What Regulators and Alcohol Producers Actually Care About

In real-world excise control, inspectors and brand owners focus on behavior, not appearance.

Their questions are practical:

-

Does the stamp clearly show if the bottle has been opened?

-

Can it be reused on refilled or substituted bottles?

-

Are tamper marks obvious without special tools?

-

Will serial numbers remain readable after handling and transport?

-

Does the stamp perform consistently across large production volumes?

Huaxin’s liquor tax stamp printing strategy starts from these enforcement realities.

The Core Logic Behind Tamper-Evident Tax Stamp Printing

A tamper-evident tax stamp must fail in a controlled, visible way.

Its value lies in how it breaks, not how it looks.

1. Irreversible Tamper Behavior by Design

Huaxin engineers stamps that cannot be removed intact through:

-

VOID-transfer constructions that expose hidden text

-

Destructible paper or film that fractures into fibers

-

Partial-transfer layers that split on removal

-

Cap-bridging seals that break when twisted

Once compromised, the stamp cannot return to a “valid” state.

2. Secure Printing That Supports Fast Inspection

Liquor tax stamps must be readable under pressure.

Huaxin integrates inspection-oriented security features such as:

-

Fine-line and guilloche patterns

-

Microtext visible under magnification

-

UV-reactive inks for spot checks

-

Optional holographic elements for high-risk markets

These features allow inspectors to verify authenticity quickly—without slowing distribution.

3. Serialization That Enforces Accountability

Tamper evidence alone is not enough.

Each stamp must carry a unique identity.

Huaxin supports:

-

Per-stamp serial numbers

-

Batch and production year codes

-

Optional QR or data matrix formats

-

Region-specific identifiers for market control

Serialization enables excise authorities to detect duplication and allows brand owners to trace irregular circulation.

4. Adhesives Calibrated for Liquor Packaging

Liquor bottles introduce difficult conditions: curved glass, foil seals, lacquered caps, and temperature variation.

Huaxin formulates adhesives that:

-

Bond permanently to glass and caps

-

Resist moisture and refrigeration

-

Leave visible residue when lifted

-

Maintain performance through long-distance transport

This prevents the most common failure of generic stamps—clean removal.

Why Standard Printing Fails Excise Control

Many stamps fail not because of design, but because of behavior under stress.

| Control Requirement | Standard Label | Tamper-Evident Tax Stamp |

|---|---|---|

| Reuse prevention | Inadequate | Irreversible |

| Tamper visibility | Subtle | Immediate |

| Serial consistency | Uncontrolled | Auditable |

| Adhesion reliability | Variable | Engineered |

| Inspection confidence | Low | High |

In excise-controlled products, a single failure can trigger audits and distribution delays.

Application Scenarios for Tamper-Evident Liquor Tax Stamps

Huaxin’s tamper-evident tax stamps are used in:

-

Spirits and distilled liquor

-

Imported alcohol under bonded control

-

Domestic excise programs

-

Duty-paid verification systems

-

Markets with high refill or reuse risk

-

Cross-border shipments subject to inspection

In every case, the stamp functions as proof of tax legitimacy.

How Huaxin Executes Tamper-Evident Liquor Tax Stamp Printing

Huaxin treats tax stamp printing as secure document production.

Printing and Control Workflow

-

Excise risk analysis by alcohol category and market

-

Tamper mechanism selection (VOID, destructible, transfer)

-

Material and adhesive matching for container surfaces

-

Secure printing and variable data integration

-

Peel, humidity, and abrasion testing

-

Batch traceability and documentation

All production follows ISO 14298 secure printing management systems, ensuring consistency and audit readiness.

Why Buyers Rely on Huaxin

Huaxin supports alcohol producers, importers, and regulatory programs with dependable tax stamp solutions.

Key capabilities include:

-

Secure printing environments aligned with ISO 14298

-

Proven tamper-evident constructions

-

High-accuracy serialization at scale

-

Adhesives engineered for liquor packaging

-

OEM manufacturing discipline for export markets

According to McKinsey’s 2024 Global Illicit Trade Report, excise stamp misuse remains one of the primary channels of alcohol tax fraud—reinforcing the need for robust tamper-evident solutions.

FAQ — Questions Procurement Teams Ask

Can tamper-evident stamps work on all liquor bottle types?

Yes, with material and adhesive adjustment per bottle design.

Can tamper evidence and serialization be combined?

Yes. Huaxin integrates both in a single stamp.

Will stamps perform under cold storage and humid transport?

Yes. Materials are tested for real logistics conditions.

Are stamps compatible with automated application lines?

Yes. Machine-ready roll formats are available.

Tamper Evidence Is What Makes a Tax Stamp Credible

A liquor tax stamp earns trust only when it visibly fails under tampering.

That failure is what protects revenue, licenses, and market integrity.

With Huaxin, tamper-evident liquor tax stamp printing is engineered around enforcement logic, inspection pressure, and real-world handling—not theoretical security.

To discuss tamper-evident liquor tax stamp solutions or request technical specifications, visit the

Huaxin homepage or contact us here